Government Contract Financing in Action

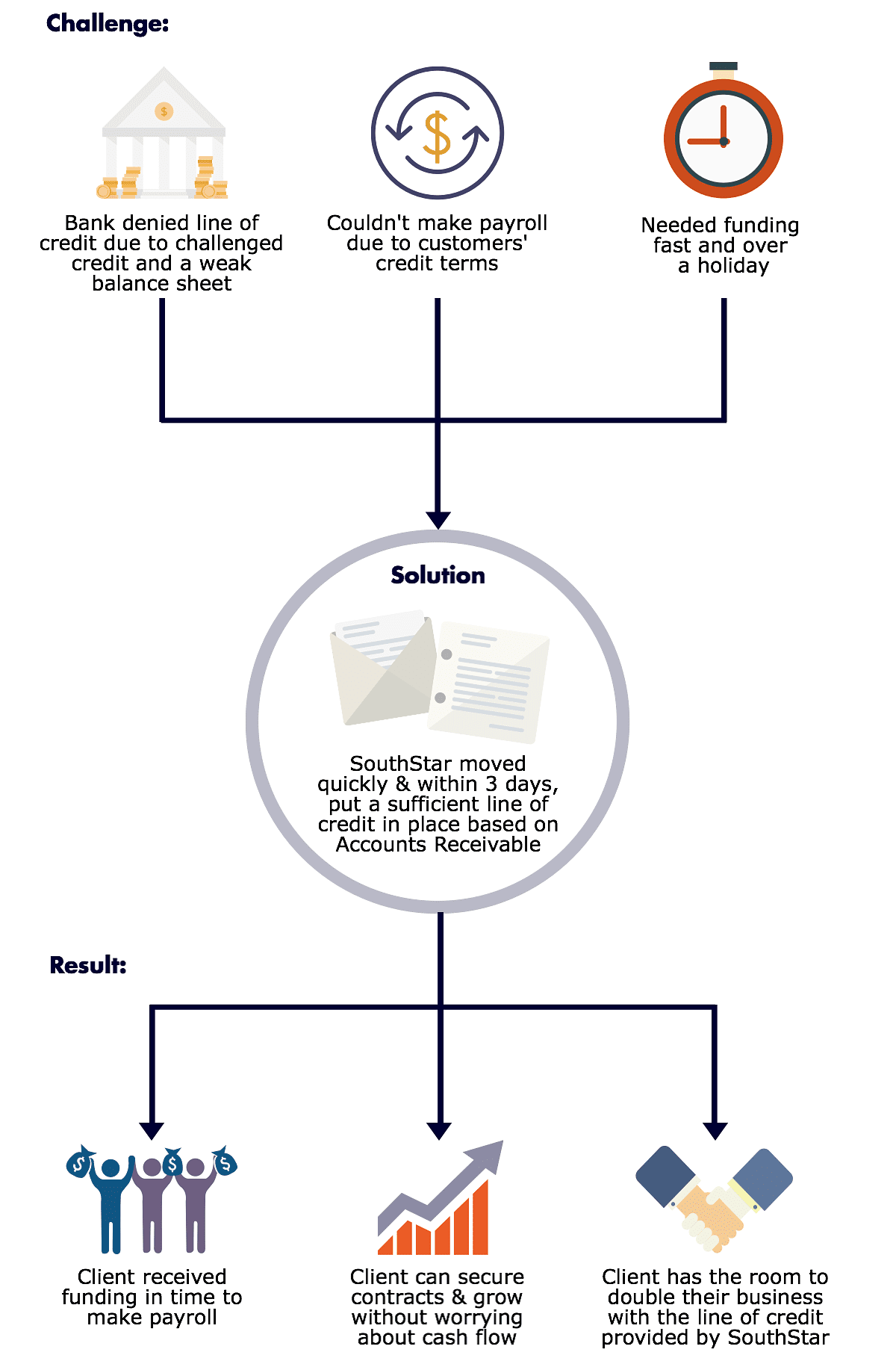

SouthStar Capital has a team of dedicated sales and operations personnel that specialize in providing Government Contract Financing to both Prime and Sub-Contractors for State, Federal, and Municipal government projects. Below illustrates one of the working capital solutions we recently provided through Government Contract Financing. PROBLEM: SOLUTION: RESULT: Contact SouthStar today to discuss how Government Contract Financing can directly benefit your company. CONTACT US TODAY!