Category: Purchase Order Financing

Is Purchase Order Financing Right for You?

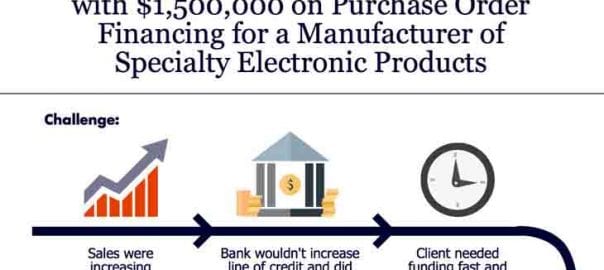

Recent Funding Solution from SouthStar

Purchase Order Financing in Action

How does Purchase Order Financing Work?

Commercial Hard Money Loans & Alternatives

With the tightening of business credit, companies are struggling to make ends meet amid a backdrop of uncertainty. Companies are taking longer to pay invoices and the effects are reverberating throughout the global economy. Banks raise interest rates and businesses are left to deal with the consequences. However, there are credit alternatives that allow companies to assume a more hands-on approach to financing their business. They include asset-based lending practices and the most common ABL financing vehicles are purchase order financing, and accounts receivables factoring. Both options empower businesses to take charge of their capital requirements and are a much

Purchase Order Financing For Small Businesses

Small business owners know that having issues with cash flow, while trying to fulfill existing customer orders, is never an easy endeavor. The customer is impressed and wants product, but the small business lacks the funds to not only purchase the raw materials, but to pay for the work needed to complete the customer’s order. Because of their uneven cash flow the small business is left with a large customer order they can’t even start! Is there a solution to such a problem? In fact, there is. It comes in the form of purchase order financing. So, what is purchase